Touring overseas might be one of the crucial rewarding and memorable adventures, however leaving your private home nation presents further challenges and dangers. In lots of instances, you’re immersing your self in a brand new tradition and maybe a language you do not know. Some locations require you to safe a visa prematurely, you would possibly want vaccinations, and a change of foreign money is one other consideration when planning your journey.

However much more vital is your well being, security, and the safety of your belongings. Over the previous eleven years of touring, we have had our fair proportion of journey situations gone mistaken (or worse), and in lots of circumstances, our determination to buy journey insurance coverage actually saved our ass—to not point out our checking account.

Let’s be sincere for a second… journey insurance coverage sucks. These corporations are banking on the truth that you may purchase a coverage and by no means have to make a declare; in any case, that is how the insurance coverage mannequin works throughout all industries. Typically worse is the hassle some insurance coverage corporations put into discovering a technique to scale back or reject your declare based mostly on the high-quality print of the coverage. Nonetheless, there are many instances the place paying for insurance coverage would possibly truly make sense, and touring overseas is commonly a type of.

Journey insurance coverage might be difficult to know, and there are normally just a few main key objects {that a} journey insurance coverage coverage gives. This could usually embody abroad medical, evacuation, journey cancellation, baggage, private belongings safety, and protection for a variety of journey sports activities and actions. We have used just a few corporations over time, however our best choice now’s HeyMondo for the simplicity of shopping for a coverage, their easy-to-use app, their customer support, and the constructive experiences we’ve had with them.

Listed below are only a few instances when shopping for journey insurance coverage actually saved the day and saved us from going broke on account of circumstances out of our management.

Stolen Laptop computer in Argentina

Again in 2013, we had been partway into our round-the-world journey and had been spending two weeks in Argentina earlier than shifting on to discover Brazil. On a random day at a pleasant café in Mendoza, western Argentina’s widespread wine vacation spot, my backpack with a laptop computer inside was plainly stolen in broad daylight. I am nonetheless unsure how the thief was in a position to distract the eye of three of us having espresso collectively, however they managed to take the bag with out a hint. On the time, we had bought a 6-month coverage to cowl the second half of our journey.

- Insurance coverage value: $300

- Laptop computer declare: $450

- Financial savings: $150

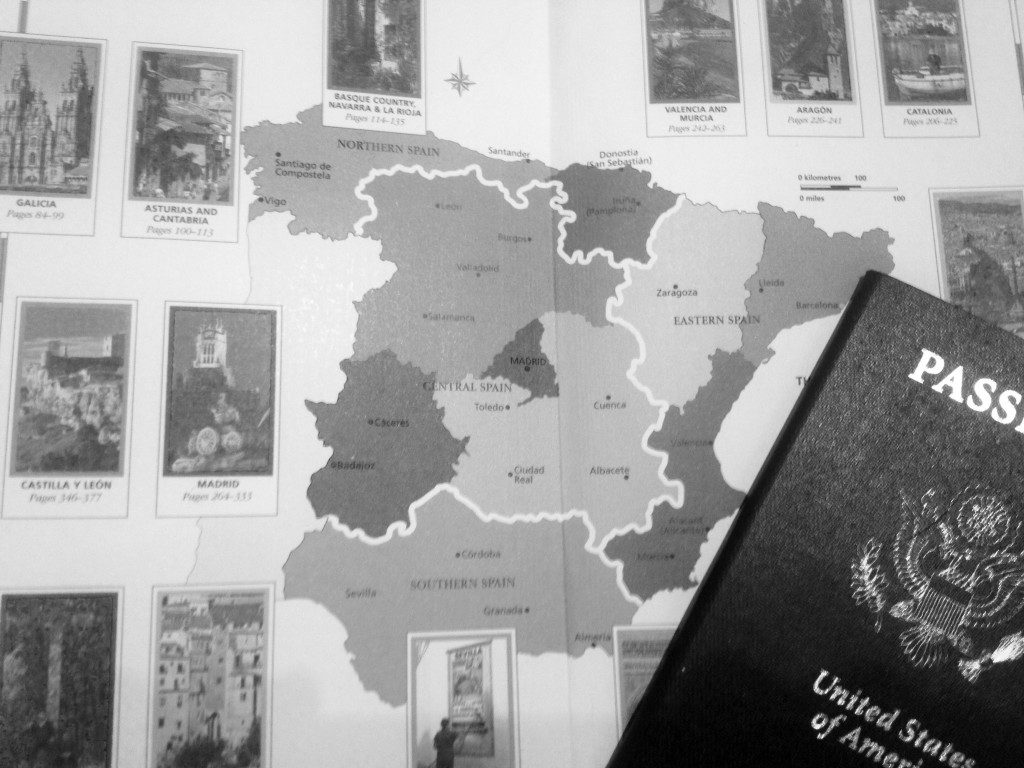

Stolen Telephone in Spain

Throughout our first yr in Spain, we had been nonetheless on a vacationer visa and did not have Spanish medical insurance. On the time, we determined to increase our journey insurance coverage coverage because it included medical protection for sickness and emergencies, to not point out numerous different coverages, together with theft. We could not have made a greater determination as a result of partway into our keep, my iPhone was stolen proper out of my pocket throughout an evening out. Whereas Spain is sort of protected total, petty theft isn’t unusual, particularly focusing on vacationers. The next morning, I went to the native police station to file a police report, which was required with a view to submit the insurance coverage declare and get reimbursed.

- Insurance coverage value: $300

- iPhone declare: $400

- Financial savings: $100

Emergency Room Go to in USA

You would possibly suppose we would have liked journey insurance coverage in Mexico or possibly Thailand probably the most, however surprisingly, we received probably the most return in our dwelling nation, america. Our most up-to-date and excessive case occurred in August 2016 throughout a visit to the US. David and I had been spending just a few days in LA and later flew to Phoenix for every week to go to household. Partway into our LA journey, David received an an infection in one of many glands in his cheek. Whereas only a bit swollen and painful, he shortly visited pressing care to attempt to catch the issue early. The physician prescribed some antibiotics, and he thought that will be the top of it. 4 days later, the an infection received so dangerous he was suggested to go to the emergency room and ended up staying for 2 nights within the hospital. Evidently, hospitalization and therapy within the US are extremely costly. Combining bills and medical payments, the full was effectively over $12,000.

- Insurance coverage value: $74

- Medical declare: $12,000

- Financial savings: $11,900+

Over the previous six years, we have most likely spent about $2,000 on journey insurance coverage insurance policies given the quantity we journey, however even that one go to to the emergency room paid for itself 5 instances over. Actually, buying a journey insurance coverage coverage is as much as you, and it is only a determination on how a lot danger you are keen to take. For those who’re touring in your house nation, you may seemingly have already got protection for any medical drawback which may come up. However if you happen to’re touring overseas, it is a a lot smarter determination so as to add a journey insurance coverage coverage for cover simply in case. For those who’re fortunate, you will not have any points and you will not want to make use of it. However typically unplanned issues occur, and also you have to be ready.

For those who’re in search of peace of thoughts from journey delays, cancellations, theft, or medical care, we personally use HeyMondo. It’s easy to purchase, with plans beginning at round $50 USD. You’ll be able to even save 5% in your coverage by utilizing our particular Two Dangerous Vacationers hyperlink right here. The plan period ranges from 1 week to 1 yr, and you’ll at all times renew your coverage on the street if you happen to’re a long-term traveler. You should buy and declare on-line, even after you’ve left dwelling, and it’s obtainable to individuals from 140 international locations. It’s designed for adventurous vacationers with protection for abroad medical, evacuation, baggage, and a variety of journey sports activities and actions.

Observe: A few of these hyperlinks are associates which implies utilizing them received’t value you any additional however we do obtain a small fee for every referral. You’re not obligated to make use of them however we respect it if you happen to do. Thanks prematurely for supporting this web site if you happen to select to make use of our hyperlink!

Featured picture credit score: CheapFullCoverageAutoInsurance.com by way of Flickr CC BY 2.0